Are Billionaire Jim Mellon’s Suggested Longevity Stock Portfolios Any Good?

In last week’s newsletter, I wrote a summary of the main takeaways of billionaire Jim Mellon’s book Juvenescence: Investing in the age of longevity. Jim is a brilliant investor and one of the most proactive in the longevity space — so you should read his book if you haven’t already.

In one of the sections of his book, Mellon gives the reader three suggested longevity biotech stock portfolios: Conservative, Moderate, and Speculative. Not all of the stocks in the portfolios are pure longevity biotech plays but most are related in some way.

Almost three years after publishing how have Mellon’s suggested longevity portfolios fared versus the S&P500 and the biotech sector (IBB)?

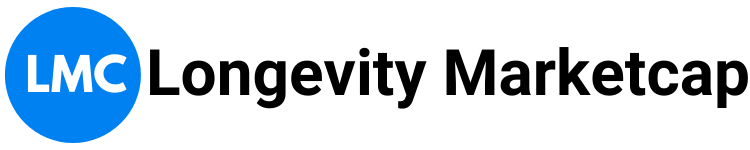

I tracked the performance of each of the longevity stock portfolio suggested in Juvenescence: Investing in the age of longevity since the publish date of September 25, 2017:

Results: Conservative Portfolio

The Conservative portfolio contains some bigger pharma stocks (Novartis, Amgen) as core holdings, so certainly not pure longevity plays. Pure regenerative medicine or longevity biotech stocks in the Conservative portfolio include Mesoblast (MESO), and Organovo (ONVO).

- In less than three years Mellon’s suggested Conservative portfolio returned about 50%.

- S&P500 returned about 31% in the same time period.

- IBB (market cap weighted biotech sector ETF) returned about 25% in the same time period.

- The biggest contributors to the portfolio gains were: CRISPR Therapeutics (CRSP) and Mesoblast (MESO).

Results: Moderate Portfolio

- The Moderate portfolio also contains two traditional pharma stocks (Novartis and Amgen) but with lower weights compared to the Conservative portfolio.

- The portfolio also includes ChromaDex, the maker of a nicotinamide riboside NAD+ supplement. I’m not a fan of the inclusion of this stock, despite the investment by Hong Kong billionaire Li-Kai Shing. Perhaps it is possible ChromaDex could see wild growth in a “detox tea” style fad, but I would rather pass on this stock.

- The Moderate portfolio had a performance of about 31% in about 3 years.

- S&P500 returned about 31% in the same time period.

- IBB (market cap weighted biotech sector ETF) returned about 25% in the same time period.

Results: Speculative Portfolio

- The Speculative portfolio drops the big pharma stocks in favour of smaller biotechs

- The Speculative portfolio had a performance of about 32% in about 3 years.

- S&P500 returned about 31% in the same time period.

- IBB (market cap weighted biotech sector ETF) returned about 25% in the same time period.

Discussion of Jim Mellon’s suggested portfolios

- All three suggested longevity portfolios either matched or outperformed the S&P500 and IBB biotech sector ETF. I chose IBB as a biotech benchmark as it is marketcap weighted, which is similar to how Mellon has allocated the portfolios.

- Readers should be aware that Conservative, Moderate, and Speculative are relative descriptors. Investing in biotech is already generally considered to be risky so regular investors would probably consider even Mellon’s “Conservative” portfolio to be risky. Moderate and Speculative portfolios even more so.

- Is it strange that the Conservative portfolio massively outperformed the Moderate and Speculative portfolios? No. Greater reward potential is usually coupled with greater risk. Nothing is certain in life except for… taxes. It’s also been only 3 years of performance so far.

- Mellon’s book was published on September 25, 2017. This was before Unity Biotechnology (UBX) and AgeX Therapeutics (AGE) went public. I imagine if Mellon were to write the book today these two would certainly be included in the suggested portfolios. Mellon is invested in AgeX through his Juvenescence company. *I own shares of UBX.

- Novartis seems like a good pick for a big pharma that has some current interest in longevity. Mellon interviewed Dr. Jay Bradner, President of the Novartis Institute for Biomedical Research, in his book and wrote that the company (along with AstraZeneca) are developing rapalogs that could be used to target aging.

- Juvenescence: Investing in the age longevity includes an index of private and public companies related to the longevity biotech industry. Not all of the publicly traded companies listed in the book are included in his suggested portfolios. Not all companies are sufficiently investible (low liquidity etc).

- The book does not discuss the specific rationale behind the inclusion or exclusion of every stock in the portfolios or the reasoning behind the allocation weights.

- Jim Mellon is British so the portfolio does include some lesser known biotech stocks listed on the London Stock Exchange. Mellon also included SalvaRx, a company he was personally involved with at the time in the portfolios.

- The biggest winners by weight included CRISPR Therapeutics (CRSP) and Mesoblast (MESO). Mesoblast is a stem cell company that is included on LongevityMarketcap.com. I like both stocks but have no position as of yet.

- The biggest losers by weight included Organovo (ONVO) and Living Cell Technologies (ASX:LCT). Organovo is a 3D bio-printing company listed on LongevityMarketcap.com

- Some of the stocks in the suggested portfolio are traded on OTC markets. I’m not a fan of OTC. The only OTC “stock” I have ever owned (and continue to own) is Grayscale Bitcoin Investment Trust: GBTC.

- Several of the stocks in the portfolios were bought out by other companies. I did not do a full portfolio simulation to account for the reinvestment of the bought out companies. I also did not include dividends, which can be notable source of return from “blue chip” biotech stocks.

- Kite Pharmaceuticals was acquired before the book could be published. I did not include its performance in the portfolio analysis.

Conclusions

Longevity investor billionaire Jim Mellon’s suggested portfolios performed well in the three years since he published them in his book Juvenescence: Investing in the age of longevity.

The Conservative portfolio performance was particularly good, with about a 50% gain in three years, outperforming the S&P500 and IBB biotech sector ETF by a wide margin. The Moderate and Speculative portfolios performed decently with around 30% gains, which is similar to the S&P500 and better than the IBB biotech sector ETF.

I don’t think any sane person would recommend going all in on any of these portfolios (Jim Mellon certainly is diversified in other investments in addition to longevity). Even if you are a believer in the longevity thesis — that it will be eventually become the biggest industry — we are still in the early early innings. Many of the promising companies are still privately held.

Personally, I would perhaps allocate a small percentage of my own speculative portfolio to a modified version of the Conservative portfolio — adding Unity Biotechnology and AgeX which were not public at the time of Juvenescence’s publishing.

As early adopters already watching the players in the space we will be in a prime position to take advantage of the explosion in trend when the signal is clear.

Until then I am staying prepared, vigilant, and patient — with some nibbling here and there.