#011: Bio Eats World?

In this edition of Longevity Marketcap Telemetry

- Notable Last Week

- Longevity Futures

- Notes on a16z’s “Bio Eats World”

- When Moon? A Roadmap for the Longevity Biotech Bubble.

*Warning: Investing in biotech is risky!

**None of this information should be taken as financial advice. It is for educational purposes only.

Notable Last Week

- Insilico Medicine Launches Pandomics. Alex Zhavoronkov’s AI drug discovery company launches an end-to-end AI-hypothesis engine that takes in OMICS + text data and spits out possible novel therapeutics.

- Aubrey de Grey contemplates SPACs. In the Foresight Institutes latest Updates video, Aubrey de Grey let slip that he is actively pursuing a plan to use a SPAC to bring a company(ies?) public. SPACs generally take less time and regulatory burden than a traditional IPO.

- Illumina buys back Grail. The gene sequencing giant decided to reacquire the liquid cancer biopsy spinout for $8 billion. For the disappointed, you can still buy Guardant Health (GH) and Exact Sciences (EXAC).

Longevity Futures

- Mesoblast FDA ruling September 30. The FDA will officially rule on whether the stem cell therapy, Ryoncil, will be approved to treat steroid refractory paediatric acute graft vs host disease. The ODAC FDA panel already ruled 9 – 1 in favour of the treatment and the FDA usually sides with the ODAC.

- Deep Longevity’s Young.ai app launch coming September 29th for iPhone. Want to use multifactorial deep aging clocks to measure the rate of your biological aging. Well, there’s an app for that.

- Longevity Investors Conference. October 1st, 2020. 12:05 PM CET. First two talks are free. The rest of the day is paid ($395). Lots of great speakers: Jim Mellon, Aubrey de Grey, David Sinclair, Nir Barzilai, Dr. Joon Yun, Eric Verdin, and many more. Register in advance

- Eurosymposium for Healthy Ageing. October 1 – 3, 2020. Free, but register in advance. Research focussed conference. Speakers include: Aubrey de Grey, Alex Zhavoronkov, Josh Mitteldorf, Irina Conboy, Greg Fahy, Nir Barzilai, and more.

My Notes: a16z’s “Bio Eats World” podcast feat. Laura Deming, Kristen Fortney and Vijay Pande

a16z is a venture capital firm founded by the legendary Marc Andreessen and Ben Horowitz. The firm invested in well-known tech and crypto entities like Twitter, Facebook, Coinbase, Stripe, Airbnb, MakerDAO, Compound, Ripple (big mistake!), among others.

Bio, in other words, is eating the world. And since we believe that biology is where information technology was 50 years ago on the precipice of changing everything, that’s why the name of the show is Bio Eats World.

Lately, a16z has increased its focus on biotech / bio-tech companies, funding companies like Asimov (programming cells), Insitro (digital biology w/ organoids), and BioAge Labs (aging biomarkers & drug discovery).

The company’s newest podcast series, “Bio Eats World”, features an inaugural episode chat with Laura Deming (founder @ Longevity Fund), Kristen Fortney (founder @ BioAge Labs), and Vijay Pande (founder @ Color Genomics, GP @ a16z).

Here are my notes and annotations on their discussion:

1. Aging Science and Research has come a long way

Cynthia Kenyon, when she was making these first studies [modulating aging in worms], was told you’ll fall off the face of the Earth, literally, if you pursue this research and you do the study.

And if you look at her first paper she was the lead author because no grad student was willing in her lab to do the work. That was such a controversial first step to take as a young principal investigator. That was how unexpected it was that people really thought that it would be the end of your career to kind of go into this field.

- Aging research has come a long way – from literal career suicide in the 1990’s to Nature (the most prestigious journal) launching “Nature Aging” — a thematic journal dedicated to aging research January 2021.

- Aging science is no longer just “theoretical”. It is currently being translated into applied therapeutic use in humans.

2. This is the critical decade for longevity

I think one thing that we feel really strongly is this is the critical decade. Patients are for the first time, receiving drugs were developed in the context of aging biology.

And when that first patient gets an actual clinical benefit, we’re going to see people actually affected by these kind of ideas that have percolated in the field for decades.

- Decades of aging research have culminated in testing actual anti-aging therapeutics in patients for the first time.

- resTORbio’s RTB101 trial targets mTOR, a pathway studied in the context of aging for ~ 25 years.

- Unity Biotechnology tested UBX0101 in patients. It is a drug that targets senescent cells, a phenomenon of aging studied for 60 years.

- The first clinical trial to use aging (all cause mortality from age-related disease) as the endpoint is already here, too. TAME: Targeting Aging with Metformin.

3. Aging biomarkers are crucial for the industry

If we just make a fast, easy, cheap, reliable biomarker for aging. That’s really going to change the whole field in a way that is more than just getting one pathway to market.

- Today, LDL cholesterol is a biomarker that acts as a surrogate endpoint for heart disease trials. Clinical trials for statin drugs only need to demonstrate they lower LDL. No need to wait for people to die of heart disease to get efficacy data.

- In the same way a biomarker for aging would accelerate the development of anti-aging drugs. Without an aging biomarker clinical trial durations would be prohibitively long or require large numbers of patients — expensive either way.

- Kristen Fortney’s company BioAge Labs, is laser-focussed on this problem. Deep Longevity, an Insilico Medicine spin out, is working on this problem too.

- There exist a number of biological aging biomarkers / clocks that have potential as clinical endpoints for anti-aging therapeutics:

- Epigenetic methylation clocks (Horvath, Grim Age).

- Levine’s Phenotypic Age (based on blood panel)

- Walking speed, grip strength, muscle mass

- Senescent cell SASP factors

- Chronokines (blood plasma factors)

- Telomere length

- Some more biomarkers for mortality by Sarah Constantin

- But how soon could we expect a surrogate biomarker for aging to become accepted by the FDA? The Framingham Heart Study took ~ 10 years to show high LDL cholesterol as a risk factor for myocardial infarction (heart attack). It wasn’t until 1987 that the FDA approved the the first cholesterol reducing drug lovastatin. This timeline probably represents the worse case scenario.

- Other FDA approved surrogate endpoints exist for a wide variety of diseases. Novel surrogates can be proposed to the FDA — here is a list of things the FDA will want to see.

4. Aging as a new paradigm for medicine

20-year olds don’t get Alzheimer’s. We cannot cure Alzheimer’s today… therapeutically it’s been a disaster…

Alzheimer’s disease, cancer, heart disease and stroke. We have to study these diseases in the context of aging, and that I think is a new perspective.

- One of the naive arguments against putting money into aging research is that we should cure other “important” diseases like cancer or Alzheimer’s first.

- Age is the single biggest risk factor for cancer and Alzheimer’s disease. Ditto for dying of Covid-19.

- There have been 149 Alzheimer’s drug failures from 1998 – 2017. The biology of the disease is still unclear.

- Anti-aging biotechnology represents a new paradigm to medicine: Target the biology of age-related diseases upstream to the disease pathology. We could potentially prevent most cancers and neurodegenerative diseases altogether in one fell swoop.

5. If you want to really impact longevity, start a company

We’re really focused right now on just getting more people to be longevity founders. … Early 2010’s, it was lack of capital… Right now the big bottleneck is founders.

- The bottleneck in longevity is that there are not enough founders.

- The misconception is that you need to make a lot of money first in order to put it back into longevity.

- Barrier to entry to biotech is getting lower. Data sets and computing is cheap. Chemistry can be outsourced (WuXi). Biology work can be outsourced (CROs). You don’t need to build your own lab to start a longevity company, just like you don’t need to build your own data center to start a tech company.

- Founders who combine knowledge in machine learning and biology will be well-equipped to start a longevity company. Both sides can be learned fairly easily.

- Starting a company to bring anti-aging drugs to trial is risky. There are not many examples to draw on. But uncertainty and opportunity are two sides of the same coin.

When Moon? Predictions for the Longevity Biotech Bubble Timeline.

Life-extending biotechnology is going to radically transform society. And a transformation of this magnitude represents the greatest investment opportunity in history.

My primary goal for starting LongevityMarketcap.com was to get people excited about longevity biotechnology so more money would pour into the space. Nothing drives progress like a good old fashioned bubble. Dot-com, crypto, cannabis, and EVs — all with conspicuous bubbles in their histories.

Billionaire investors like Jim Mellon and Peter Thiel know the longevity biotech bubble is coming. But when will it arrive?

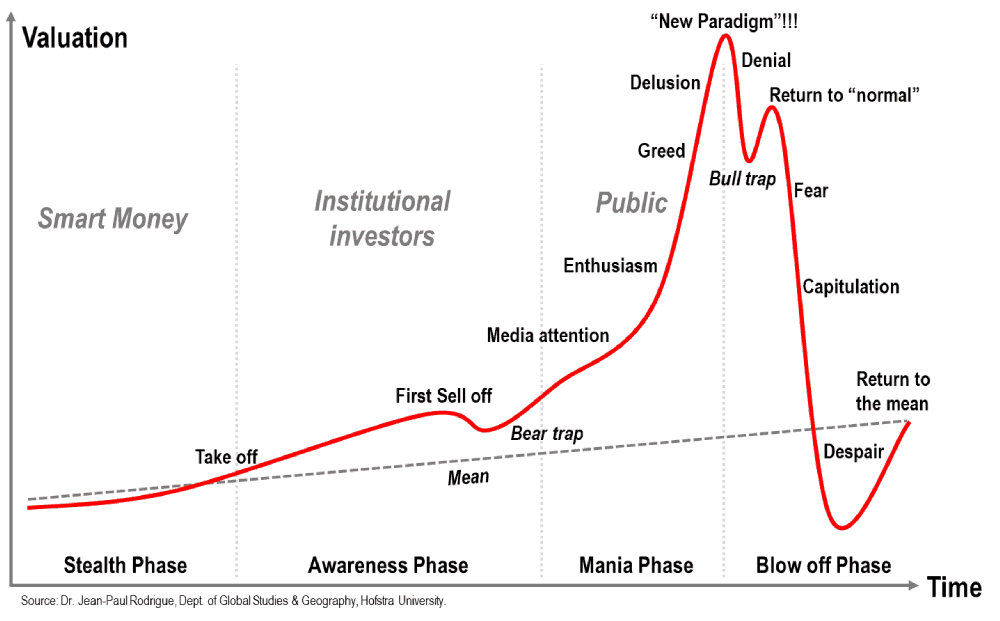

The chart above is an (overused) illustration of the typical trajectory of an investing bubble. Many a fortune have been gained and lost on speculation on which phase a bubble is in at any time.

Let’s add fuel to the fire. My thoughts:

No Mania… yet

In my opinion, we are at the beginning of the Awareness Phase of the longevity biotech bubble. There are several longevity venture capital funds. Hundreds of companies. Many longevity conferences.

But the public is mostly unaware of the coming revolution. Only longevity nerds like you and me know about this stuff. And our early faith in the space will be rewarded.

There’s been very little mainstream media coverage. This will change once people start getting famously rich from investing or building companies in the space.

Signs of growth

But the direction of growth is clear. When Laura Deming started the Longevity Fund in 2011, there were only a handful of companies to invest in. Almost a decade later, there are hundreds of startups in the longevity space.

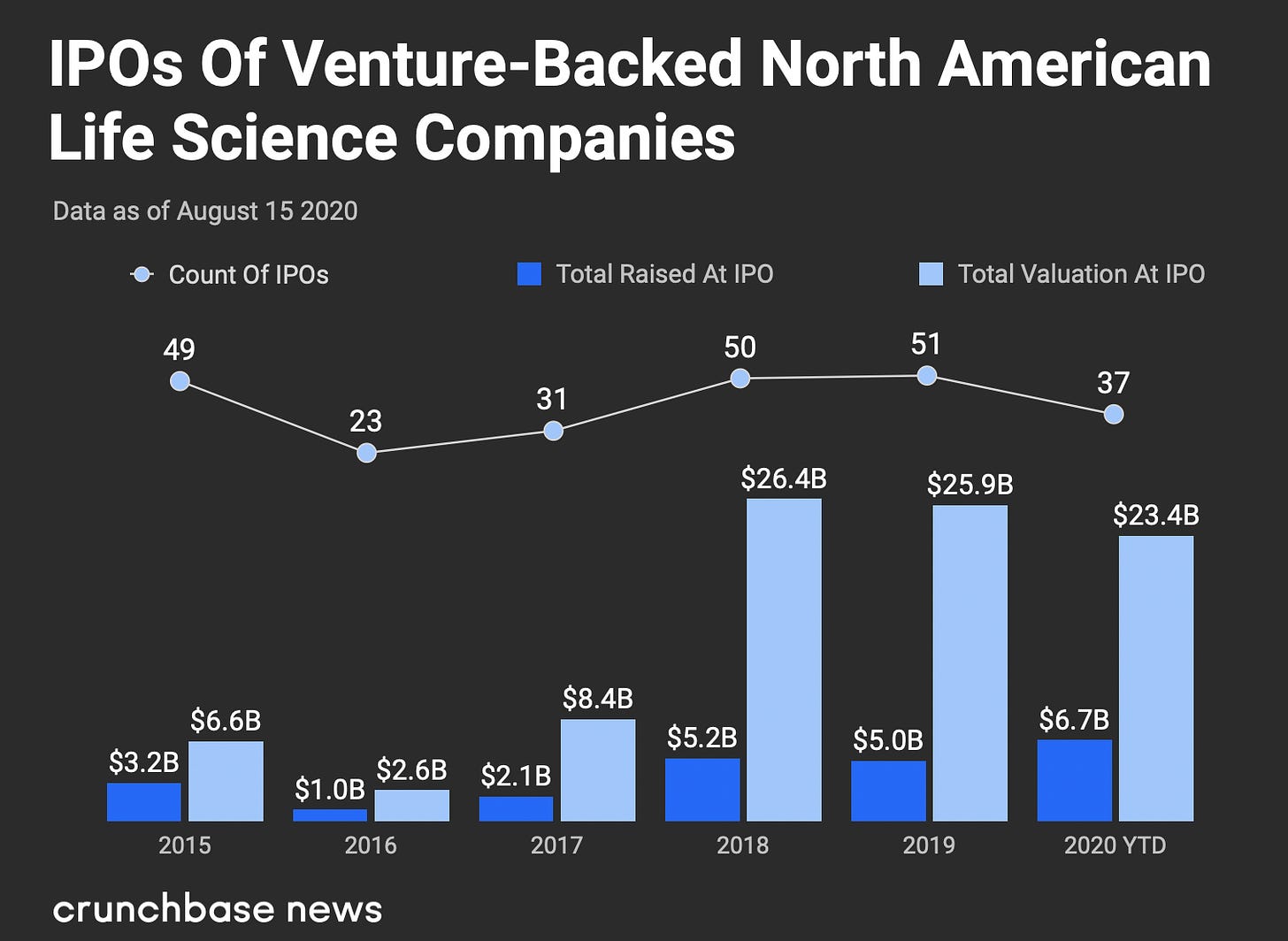

Biotech in general is seeing remarkable growth in investor interest. And public investing opportunities are increasing too.

From January to August this year, 37 venture-backed biotech companies filed for IPO, raising ~$7 billion — on track to be the highest in 5 years.

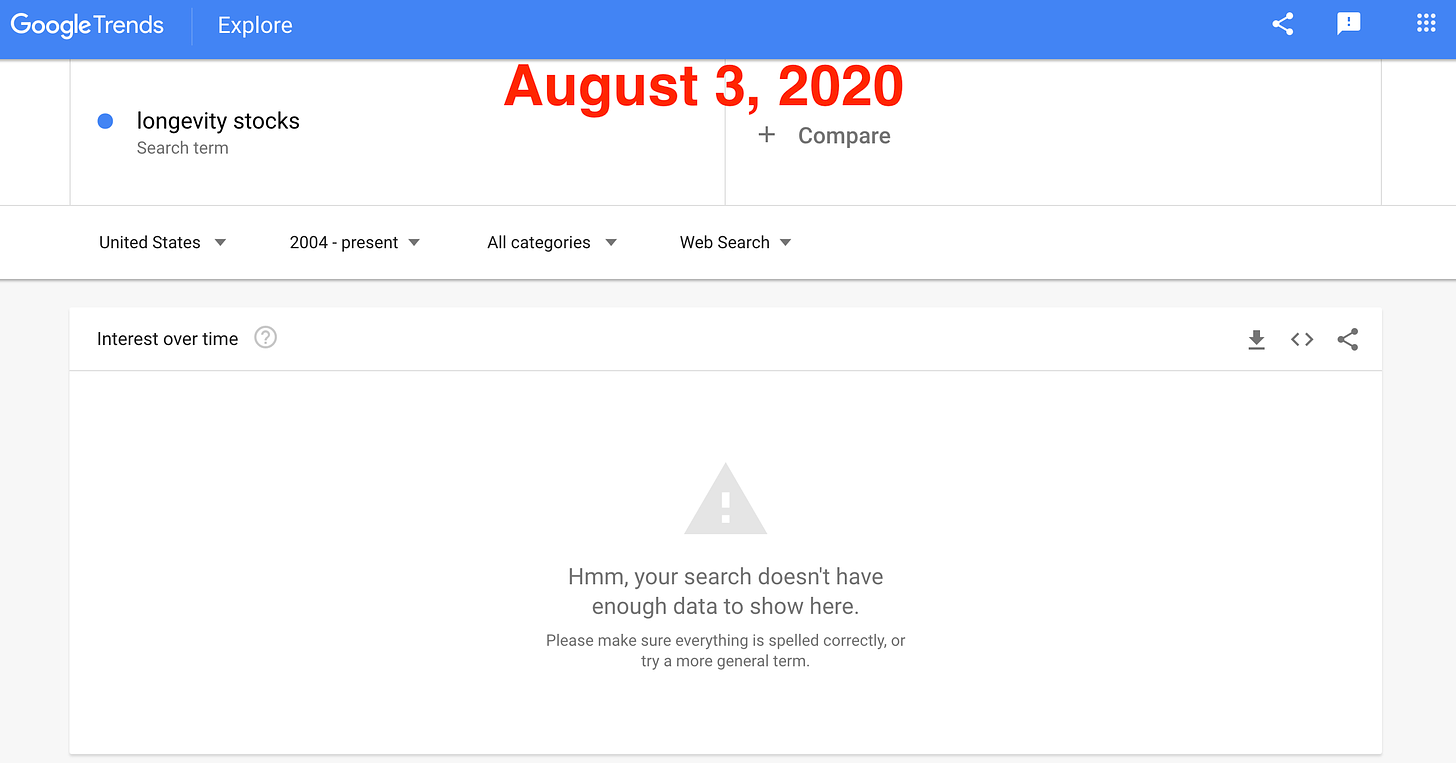

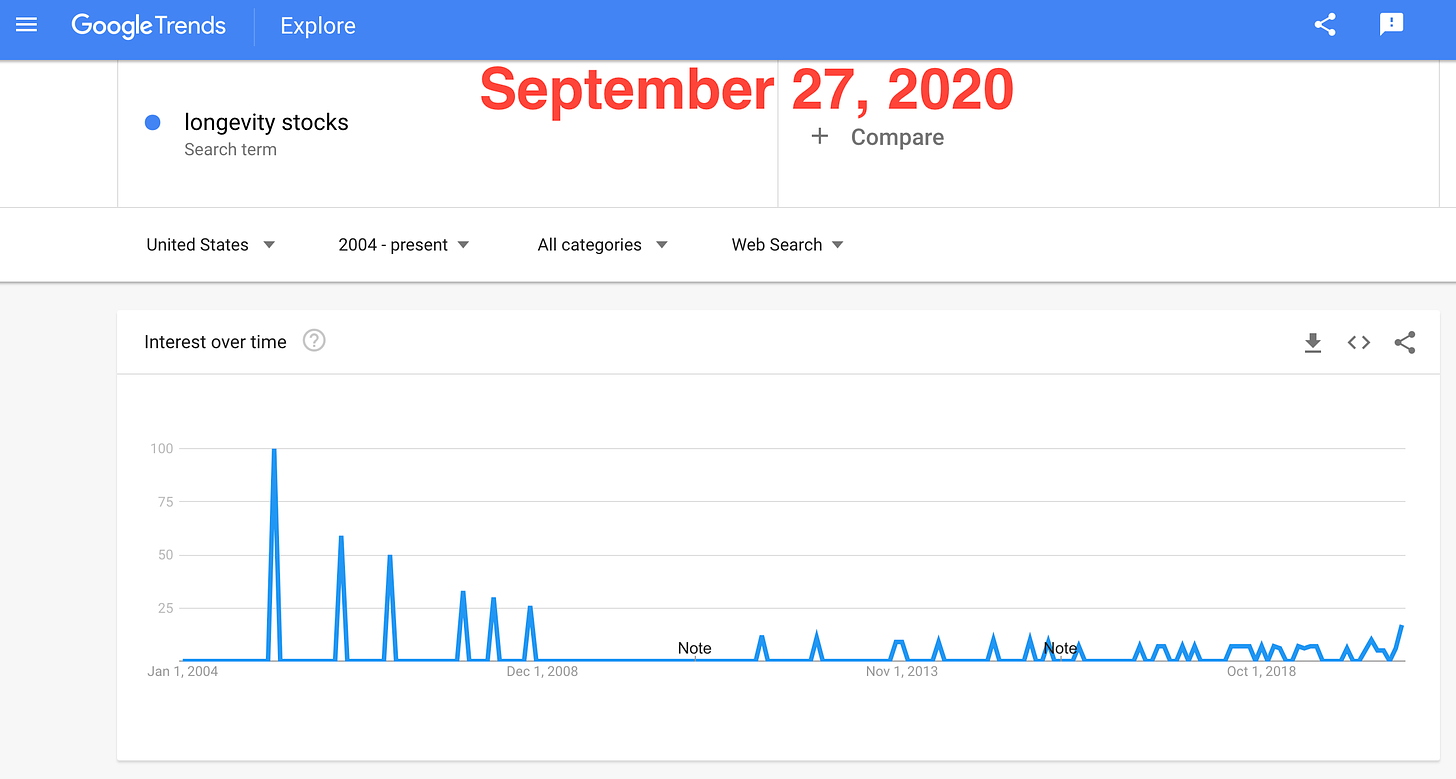

Longevity stocks are also seeing some growing interest, despite their limited number.

In Newsletter #003 (August 3, 2020), I noted that the Google Trends search for “longevity stocks” yielded no data:

But if you search for “longevity stocks” in Google Trends today we can see there is some life. Another year of data will confirm whether this is just a passing spike or something more durable. I imagine a Juvenescence IPO could cause a major stir.

Note: The spikes in the chart during the 2000’s era were most certainly due to David Sinclair’s Sirtris Pharmaceuticals. It was acquired by GlaxoSmithKline in 2008 for $725 million only to be shut down a few years later.

How the Bubble Ends.

The upcoming batches of public longevity companies are destined for meme stock glory. Anti-aging is simply too big and too relatable to escape the likes of Robinhood and /r/wallstreetbets.

I predict the hype will easily outpace the progress. The bubble will inflate and deflate well before any of these anti-aging therapeutics reach the mass market.

Clinical trials take time. Buying a stock takes a second.

Remember this:

Years from now, when CNBC and Bloomberg start reporting on longevity biotech on their front pages with increasing frequency. When your relatives start asking you about which longevity stocks to invest in. When you start wondering whether “this time could be different”.

That’s when you need to start taking profits.

But of course remember to keep a portion in your HOLL (Hold on for Long Life) account.

-NATHAN CHENG✓

Technical Analysis

“No matter how sophisticated our choices, how good we are at dominating the odds, randomness will have the last word.”

– Nassim Taleb, Fooled By Randomness

Frequency Therapeutics (FREQ)

Daily Chart

Several weeks ago I noted this progenitor cell activation drug developer was getting close to hitting a TD sequential 9 Buy on the daily scale. The 9 was reached and the stock popped 30% several days later on positive Phase 2a data (sustained improvement in hearing in some patients).

The enthusiasm peaked (almost on a TD 9 sell) and we began to correct. It looks like a 1 – 4 candle correction could be finished since we bounced off the 200 day SMA.

The company has a valuation of almost $700 million — it’s certainly investible. I’m already invested but looking to slowly add more.

(For my in-depth analysis on Frequency Therapeutics read newsletter #010)

ChromaDex (CDXC)

I’m not interested in investing in this company — they make nicotinamide riboside, a popular NAD+ “longevity” supplement. I know David Sinclair does research in this area but I am still skeptical.

As a trade it looks interesting.

The stock is down 30% from is peak a month ago and coming up what could be a double TD 9 Buy on the daily scale. Market cap is only ~ $250 million, but hey that’s higher than Unity Biotechnology! (Too soon?)

Generally, I prefer to trade assets that I wouldn’t mind to hold onto long term. ChromaDex does not fit this description. But readers may feel differently.

Schrodinger (SDGR)

This hot computational chemistry and drug discovery company IPO’d early this year. The stock tripled before topping in July. Now it is down over 50% from the peak with a TD 9 Buy weekly already triggered.

I think this stock is in need of a relief rally at the very least — something more than the 3% it got two weeks ago. I’m interested but not committed to buying.

Compass Pathways (CMPS)

Hourly Chart

Not a longevity stock but worth mentioning. Compass Pathways has all the makings of a perfect meme stock:

- Magic mushrooms for treating mental illness

- Backed by Peter Thiel and Tim Ferris

- Wild IPO price action

I’m already invested in Compass Pathways, but interested to see if there is a trade opportunity — given the volatility.

The 1 hour chart seems pretty good at calling out the tops so far. I am interested to see how far this goes. The stock is already up ~ 90% from the first trading day close last week.

Regent Pacific (HKEX:575)

This is Jim Mellon’s holding company that acquired Deep Longevity, an Insilico Medicine spin out. The company is probably too small to make any meaningful investment in it (market cap is ~$27 million USD). Their main business is selling Fortacin, an OTC topical spray treatment for premature ejaculation.

We are coming up on a TD 9 buy on the daily scale after a massive run up and 50% pullback. Interesting.