Juvenescence: Investing in the age of longevity — Book Notes

Juvenescence: Investing in the age of longevity is a book written by British billionaire investor Jim Mellon and Al Chalabi. The book surveys the science, people, and companies within the longevity biotechnology space and offers an investor’s perspective.

This book summary will review the scope and investing thesis of the book and highlight some of the most thought-provoking quotes and ideas — annotated by my own perspective.

The longevity biotech market will not just be huge. It will be the biggest.

We are also fortunate to be present at the birth of a new industry –the business of longevity. This industry will be bigger than technology, alternative energy, transportation, education, and the rest of the zeitgeist sectors du jour put together….

With a market defined only by the size of the world’s population, and with the science now catching up to the aspirations of life-extensionists, this is truly the biggest money fountain we have ever seen.

-Jim Mellon, Al Chalabi. Juvenescence: Investing in the age of longevity

Why should you bother listening to billionaire investor Jim Mellon? Well let’s take a look at his track record:

In 2012, Jim Mellon and Al Chalabi published Cracking The Code which predicted the coming genomics biotech revolution. The IBB Biotech sector ETF has returned roughly 300% since then –doubling the performance of the S&P500.

The authors then wrote Fast Forward in 2014 to alert investors to the growing AI, tech, and robotics revolution. The XLK Tech sector ETF has returned 200% since then, also more than doubling the S&P500 returns over that time period.

In 2017, the duo returned with a new book Juvenescence: Investing in the age of longevity, which predicts the coming revolution in anti-aging and rejuvenation biotechnology.

Will Jim Mellon’s investing prediction be right for the third time in a row?

It is still early days in the longevity industry, but funding is starting to pour in and the number of startups in the space is growing rapidly. I firmly believe that long-term growth in this market is inevitable. The only steelman argument I find even remotely plausible is that maybe we are too early.

But will the longevity biotech industry really be the biggest industry by size, as Mellon and Chalabi claim?

Extrapolating the possible size of longevity from the healthcare market gives us a clue that it could be true. Aging is a fatal disease that causes death and untold suffering.

And it affects each of the 7 billion people on this planet.

If each person would be wiling to pay on average the cost of a Netflix subscription to reverse their biological age and add decades to their life, that would already be a 1 trillion dollar market.

But the true scope of the longevity industry can be more understood through the lens of the purpose of technology itself.

As Balaji Srinavasin writes:

If the proximate purpose of technology is to reduce scarcity, the ultimate purpose of technology is to eliminate mortality….

…Think about how a breakthrough is described: faster, smaller, cheaper, better. All of these words mean that with this new technology, one can do more with less.

… mortality is the main source of scarcity. If we had infinite time, we would be less concerned with whether something was faster…

If you made lifespans much longer, you’d reduce the effective cost of everything. Thus insofar as reducing scarcity is acknowledged to be the proximate purpose of technology, eliminating the main source of scarcity – namely mortality – is the ultimate purpose of technology. Life extension is the most important thing we can invent.

Balaji Srinavasin, The Purpose of Technology

Longevity will give people not just more youth and health. It gives people more time.

And time is money.

Longevity biotech is not Tech. It will not be “winner takes all”.

But the flow of public companies will come thick and fast. Already the area is attracting large amounts of money, and some big, enlightened companies (such as AstraZeneca and Novartis) are looking seriously at longevity as a business opportunity…

…But the really impressive gains will be made by investing in the companies that are now under the radar, or just emerging from the shadows…

-Jim Mellon, Al Chalabi. Juvenescence: Investing in the age of longevity

So, from immunotherapies, to repurposed “old” drugs, to senolytics, to gene therapies, to stem cells, to mitochondrial uncouplers, to mTOR pathway inhibitors (including the rapalogs), to NAD + precursors, to resveratrol and more, we lay our investment feast on the table for you…

-Jim Mellon, Al Chalabi. Juvenescence: Investing in the age of longevity

One of the most important predictions made in Juvenescence is that longevity biotechnology will not be a winner takes all situation like in the tradition tech sector (Facebook, Google, Amazon, etc). The main reasoning here is that biological aging is believed to have heterogenous modalities which each need to be treated separately.

Is this a reasonable assumption to make?

The “Many Winners” hypothesis hinges on the belief that “programmed aging” or “master clock” theories of biological aging are incorrect or practically intractable. Thus there would be no one drug or treatment that could reverse aging altogether in one swoop. No anti-aging monopoly.

Instead the prevailing SENS approach is taken: Ignore the uber-complex metabolic pathways that cause aging and instead repair the varieties of damage (Hallmarks of Aging).

However there are still some in the anti-aging science community that believe in some master program, switch, or clock that is upstream from all the molecular damage “Aging Hallmarks” that can be reversed. Josh Mitteldorf (https://joshmitteldorf.scienceblog.com) and Harold Katcher (researcher of the recent epigenetic age reversal of mice via young blood bombshell) are some examples.

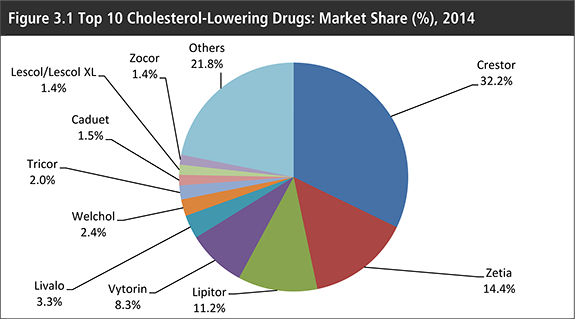

But even if some aspects of programmed aging are true there should still be enough biological variation within humans to warrant a variety of different drugs or therapies in the market. An example that Celine Halioua gave in her Tech vs Biotech article: The market for statins (to treat high cholesterol) had by 2020 generated over 1 trillion dollars in sales across 7 different drugs. Lipitor, one of the most popular of the statins, had peak sales of 12 billion dollars in 2012.

There will be plenty of room for many winners. But there also will be many more losers, frauds, and scandals — which brings us to the next point:

There will be many failures.

Because the science is so complex, and indeed contentious, this is not an area where darts can be thrown at the bull market. There will be multiple failures, several scandals (along the lines of Theranos), and many, many disappointments. Selection is key; knowledge is vital –and hard work even more important.

-Jim Mellon, Al Chalabi. Juvenescence: Investing in the age of longevity

The product-market-fit for longevity and biotech in general is understood. It is the engineering and the science which is not. The reverse is true for traditional technology companies — companies know what they can build but are unsure if people will use it.

Biology is complex in ways that transistors and software are not. And the regulatory burden from the inherent uncertainty means the cost to bring a drug to market today is in the billions of dollars.

We will see many promising companies fail in spectacular fashion. The longevity gold rush will also attract many fraudsters and scandals. Even “smart money” will get duped.

As an investor it will take intensive due diligence to vet these companies. The other alternative is to buy a broad-based longevity ETF, when they inevitably arrive.

As Jim Mellon said in an interview in 2019 regarding longevity funds:

“There are a maximum of 10 funds focused on Longevity,” he said. “There’ll be 50-70 in the next few years and in 10 years’ time there’ll be thousands. The Longevity investment market is like the cannabis market – it will grow very quickly, but it will be much bigger.”

Not just drugs.

This new world is one where drugs, genetic engineering, cellular enhancements and organ replacements, amongst other interventions will add decades to our potential lifespan…

-Jim Mellon, Al Chalabi. Juvenescence: Investing in the age of longevity

When people visualize a cure for aging they probably think of some sort of pill or injection. The authors believe that the advances in longevity biotechnology will include more than just small molecule therapeutics, though they certainly represent the bulk of the current approaches.

In fact there are many companies working on non-drug / supplement rejuvenation approaches and investors should be on the look out for them.

Here are some non-drug longevity biotech examples:

Xenotransplantation

Instead of repairing old aged organs, xenotransplantation makes use of healthy organs transplanted from animals (pigs being the leading candidate). In order to ensure compatibility in the host, various approaches are used to bioengineer the animal organs.

Here are some companies working on xenotransplantation:

- eGenesis: Co-founded in part by legendary geneticist George Church. Using transgenic pigs that are engineered to be free of endogenous viruses and missing certain factors that trigger an immune response in humans. It is a privately held company.

- Revivicor: Similar approach as above. Revivicor is owned by United Therapeutics ($UTHR) and the worldwide distribution rights for Revivicor’s xenotransplant organs have bough by Zimmer Holdings ($ZBH).

From an investor standpoint xenotransplantation is an attractive venture since companies can generate revenue even before the technology is fully perfected for longevity. There is already a shortage of human organs for terminally ill patients so an early stage xeno-organ product only needs to be better than nothing. Testing in terminally ill patients might also face fewer regulatory roadblocks.

3D Printing Tissues and Tissue Regeneration

A number of companies are developing the technology to 3D print or create new tissues and organoids. The technology could potentially be further developed to create whole organs.

Here are some of the companies in the space:

- Organovo ($ONVO): A publicly traded company based in the US that does 3D bioprinting of tissues that mimic key aspects of human biology and disease. Their goal is to use these tissues for therapies or for drug discovery research.

- Lygenesis (private): One of the companies funded by Mellon’s Juvenescence, they are growing human tissues, organoids, and possibly whole organs in lymph node bioreactors.

- Cellink ($CLNK-B): They develop bio-inks and bioprinters used to culture different cell types.

Young blood factors

Yes, the blood boys from HBO’s Silicon Valley are based on real science. In 2005, Tom Rando at Stanford University made the discovery that a young mouse could restore the liver and muscles of an older mouse by surgically conjoining the two mice together. Companies are currently developing technologies around young blood, which is believed to explain the observed rejuvenation. Here are some companies working in this area:

- Alkahest (private) : Developing the technology to decode the plasma proteome to find “chronokines” targets– blood factors that increase or decrease with age — to treat degenerative diseases.

- Nugenics (private) : The company that will be commercializing the young plasma factors that were claimed to have reversed the epigenetic age of old mice.

Stem Cell and other Cellular Therapies

Stem cells are cells that can be differentiated into different types of cells and represent a promising modality for longevity therapeutics and tissue regeneration. Here are some longevity biotech companies working in this space:

Mesoblast Therapeutics ($MESO): This Australian company develops allogenic cellular technologies using mesenchymal lineage stem cells to treat a wide range of diseases.

AgeX ($AGE): This US-based pre-clinical company is backed by Jim Mellon, develops stem cell and induced tissue regeneration technologies to possibly target cardiac ischemia and diabetes.